Finding a pawn shop in your area can often be a daunting task, especially if you’re looking for reliable services and fair transactions. That’s why local pawn shops, like Pawn Central in Galesburg, IL, are invaluable resources for buying, selling, and pawning items. In this article, we will explore the basics of pawn shops, how to locate them, the benefits they provide, and what to expect when you step into Pawn Central. We will also discuss the common items typically accepted for pawning or selling.

Understanding the Basics of Pawn Shops

Pawn shops have been around for centuries and serve an essential function in their communities. At their core, they are financial institutions that allow customers to obtain short-term cash loans against the value of their personal items. The items pledged as collateral are known as pawns, and if the borrower fails to repay the loan, the pawn shop has the right to sell those items.

While many people associate pawn shops with negative stereotypes, they can be a valuable resource for quick funds. The process involves bringing in an item of value, receiving a loan offer based on its worth, and signing a pawn ticket that details the terms of the loan. Unlike traditional loans, pawn shop loans do not require credit checks or lengthy applications.

Pawn shops typically deal with a wide range of items, from jewelry and electronics to musical instruments and collectibles. This diversity allows them to cater to various customers, whether someone is looking to pawn a family heirloom or a vintage guitar. The appraisal process is often quick and straightforward, with trained staff evaluating the item’s condition, market demand, and resale potential. This means that individuals can leave the shop with cash in hand within a matter of minutes, making pawn shops an attractive option for those in need of immediate financial assistance.

Moreover, pawn shops also contribute to the local economy by providing a marketplace for buying and selling second-hand goods. Many shoppers frequent these establishments not only for the potential bargains but also for the unique items that can often be found. From rare coins to antique furniture, the inventory in a pawn shop can be a treasure trove for collectors and bargain hunters alike. This dual role of lending and retailing helps to create a vibrant community atmosphere, where both borrowers and buyers can benefit from the exchange of goods and services.

How to Locate Pawn Shops in Your Area

Finding a pawn shop near you can be straightforward if you know where to look. Here are some effective methods for locating a pawn shop:

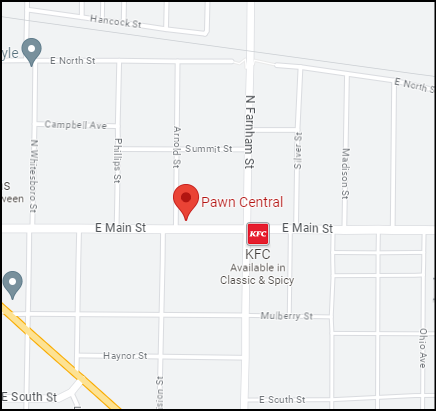

- Online Search: Utilize search engines by entering “pawn shops near me” or “pawn shops in Galesburg, IL.” This method will provide you with a list of nearby shops along with customer reviews and ratings.

- Maps and Navigation Apps: Use apps like Google Maps or Apple Maps. Simply input “pawn shop” into the search bar, and it will show you the nearest locations.

- Social Media: Local community groups on platforms such as Facebook can be a great resource for recommendations, allowing you to see which pawn shops are trusted by others in your area.

Once you find a few options, consider visiting their websites or calling them to get an idea of the services they offer, as well as their hours of operation.

In addition to these methods, you might also want to check local classifieds or community bulletin boards, which often feature advertisements for pawn shops. Many pawn shops also participate in local events or fairs, providing an excellent opportunity to meet the owners and learn more about their inventory and services. Engaging with the community can yield valuable insights into which shops have the best reputation and customer service.

Another useful approach is to ask friends or family if they have any recommendations. Personal experiences can guide you to reputable shops that may not be as visible online. Additionally, some pawn shops specialize in certain items, such as jewelry, electronics, or musical instruments, so knowing what you’re looking for can help narrow down your search and lead you to the most suitable options in your area.

The Benefits of Using a Local Pawn Shop

Using a local pawn shop like Pawn Central can provide numerous benefits. First and foremost, local shops tend to cultivate relationships with their customers, leading to more personalized service. Here are several advantages of using a pawn shop in your community:

- Immediate Cash Flow: Local pawn shops can provide quick cash when you need it most, giving you the financial relief to cover unexpected expenses.

- No Credit Checks: Unlike banks or credit unions, pawn shops do not perform credit checks, allowing individuals of all financial backgrounds to access funds.

- Convenience: Having a pawn shop in your local area means you can easily drop by to buy, sell, or pawn items without traveling far.

- Supporting Local Business: Using a local pawn shop supports your local economy and helps sustain jobs within your community.

How to Choose the Right Pawn Shop for Your Needs

Choosing the right pawn shop can greatly affect your experience. Here are some key factors to consider:

- Reputation: Check online reviews and ratings to gauge the experiences of other customers. A shop with a solid reputation is likely to offer better service and fairer deals.

- Services Offered: Make sure the pawn shop offers the services you need, whether it’s pawning items, buying goods outright, or providing loans.

- Customer Service: A friendly and knowledgeable staff can make the experience more enjoyable and help you make informed decisions.

Visiting several pawn shops in Galesburg can help you determine which one aligns best with your needs, offering the right balance of service and convenience.

What to Expect When Visiting Pawn Central

When you visit Pawn Central, you can expect a welcoming atmosphere and professional service. Here’s what typically occurs during your visit:

- Initial Assessment: Bring in your item, and a staff member will assess its value. They will consider brand, condition, and market demand.

- Loan Offer: Based on the assessment, you will receive a loan offer or a purchase price. You can choose to accept or decline the offer.

- Pawn Ticket: If you decide to pawn the item, a pawn ticket will be generated, outlining the loan amount, terms, and repayment due date.

Throughout the process, the knowledgeable staff will be there to answer any questions and provide guidance.

Common Items You Can Pawn or Sell

Pawn shops typically accept a wide variety of items. Here is a list of common goods that you can pawn or sell at Pawn Central:

- Jewelry: Rings, necklaces, bracelets, and watches are often highly valued due to their intrinsic metal and stone worth.

- Electronics: Items like smartphones, tablets, laptops, and gaming consoles have strong market demand.

- Musical Instruments: Guitars, keyboards, and other instruments can fetch good prices depending on their condition.

- Power Tools: High-quality tools that are in working condition are popular among both pawn shops and DIY enthusiasts.

By knowing what items are commonly accepted, you can better prepare for your visit, ensuring that you get the best value for your possessions.

In conclusion, pawn shops like Pawn Central in Galesburg, IL, offer a range of services that can be beneficial for anyone in need of quick cash or looking to buy unique items. Understanding the basics, how to locate them, and what to expect can enhance your experience, making the process smooth and rewarding.