In today’s rapidly changing political climate, global events have far-reaching impacts on financial markets, including precious metals like gold and silver. At Pawn Central, with stores in Galesburg and Rock Island, IL, and Clinton, IA, we understand that our customers might feel uncertain about when to invest in or sell their precious metals. This blog aims to shed light on how current political stressors affect gold and silver prices, and provides valuable tips for making informed decisions.

The Impact of Political Stressors on Precious Metals

Political events, both domestic and international, can create significant volatility in the precious metals market. Here are a few key factors to consider:

- Geopolitical Tensions: Escalating conflicts, such as trade wars or military confrontations, often lead to increased demand for safe-haven assets like gold and silver. Investors flock to these metals to hedge against economic instability, driving prices up.

- Economic Policies: Decisions by governments and central banks, such as changes in interest rates or monetary policy, can influence precious metal prices. For example, lower interest rates typically weaken the dollar, making gold and silver more attractive investments.

- Inflation Concerns: Political decisions that affect inflation, such as fiscal stimulus measures, can also impact precious metals. Investors often turn to gold and silver as a hedge against inflation, which can drive prices higher.

Recent Political Stressors and Their Effects

Recent political events have underscored the sensitivity of precious metals to geopolitical stressors:

- Trade Wars and Tariffs: Ongoing trade disputes, especially between major economies like the U.S. and China, have led to market uncertainty. This uncertainty boosts demand for gold and silver as investors seek stability.

- Pandemic-Related Policies: Government responses to the COVID-19 pandemic, including stimulus packages and economic shutdowns, have affected global economic stability. These responses have resulted in fluctuations in precious metal prices as investors react to changing economic conditions.

- Political Instability: Events such as the attempted assassination of former President Trump create significant political uncertainty. Such incidents can lead to increased volatility in financial markets, prompting investors to seek refuge in gold and silver.

The Impact of Political Stressors on Precious Metal Market

Political events, both domestic and international, can create significant volatility in the precious metals market. Here are a few key factors to consider:

- Geopolitical Tensions: Escalating conflicts, such as trade wars or military confrontations, often lead to increased demand for safe-haven assets like gold and silver. Investors flock to these metals to hedge against economic instability, driving prices up.

- Economic Policies: Decisions by governments and central banks, such as changes in interest rates or monetary policy, can influence precious metal prices. For example, lower interest rates typically weaken the dollar, making gold and silver more attractive investments.

- Inflation Concerns: Political decisions that affect inflation, such as fiscal stimulus measures, can also impact precious metals. Investors often turn to gold and silver as a hedge against inflation, which can drive prices higher.

Recent Political Stressors and Their Effects

Recent political events have underscored the sensitivity of precious metals to geopolitical stressors:

- Trade Wars and Tariffs: Ongoing trade disputes, especially between major economies like the U.S. and China, have led to market uncertainty. This uncertainty boosts demand for gold and silver as investors seek stability.

- Pandemic-Related Policies: Government responses to the COVID-19 pandemic, including stimulus packages and economic shutdowns, have affected global economic stability. These responses have resulted in fluctuations in precious metal prices as investors react to changing economic conditions.

- Political Instability: Events such as the attempted assassination of former President Trump create significant political uncertainty. Such incidents can lead to increased volatility in financial markets, prompting investors to seek refuge in gold and silver.

Investing in or Selling Precious Metals: What to Consider

If you’re considering investing in or selling your precious metals, here are some key points to keep in mind in precious metal markets:

- Market Trends: Stay informed about current market trends and political events. Monitoring news sources and financial reports can help you anticipate potential impacts on gold and silver prices.

- Timing: Timing is crucial in the precious metals market. While it’s challenging to predict market movements with certainty, being aware of major political events and their potential implications can help you make more informed decisions about when to buy or sell.

- Diversification: Diversifying your investment portfolio can help mitigate risks associated with political and economic instability. While gold and silver are valuable assets, consider balancing your investments with other types of assets to protect your overall financial health.

- Expert Advice: Consulting with financial experts or trusted professionals at Pawn Central can provide valuable insights and guidance. Our knowledgeable staff can help you understand market conditions and make informed decisions about your precious metals.

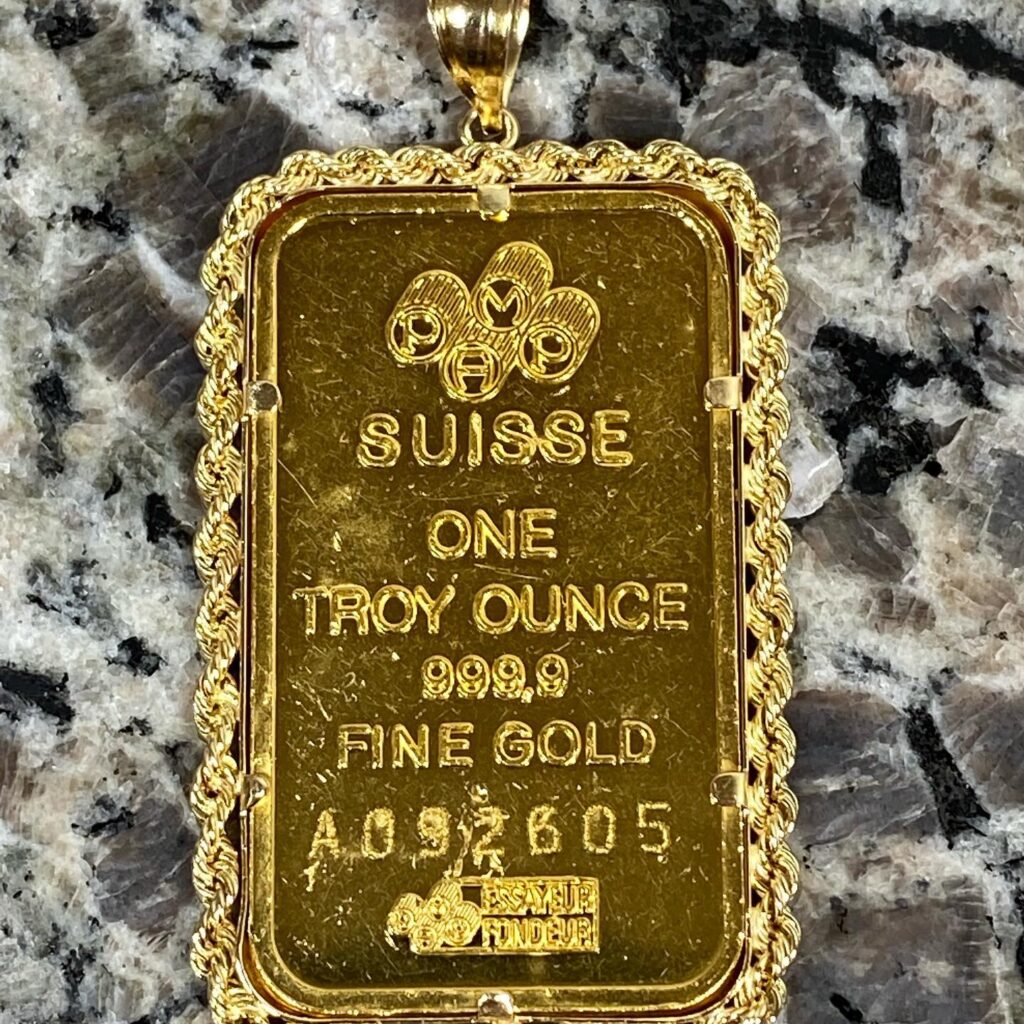

- Condition and Purity: When selling gold or silver, the condition and purity of the metal play a significant role in determining its value. Ensure your precious metals are appraised accurately to get a fair price.

- Storage and Security: If you’re investing in precious metals, consider secure storage options to protect your assets. Pawn Central offers safe and reliable storage solutions for your gold and silver investments.

Why Choose Pawn Central?

At Pawn Central, we pride ourselves on offering comprehensive services to help our customers navigate the complexities of the precious metals market. Here’s why you should choose us:

- Trusted Expertise: Our team has extensive experience in evaluating and appraising precious metals. We provide fair and accurate assessments to ensure you receive the best value for your assets.

- Transparent Transactions: We believe in transparency and integrity. Whether you’re buying or selling, we ensure that all transactions are conducted openly and honestly.

- Customer-Centric Approach: Our customers are at the heart of everything we do. We strive to provide personalized services tailored to your unique needs and goals.

- Convenient Locations: With stores in Galesburg and Rock Island, IL, and Clinton, IA, Pawn Central is easily accessible. Visit us to discuss your precious metal investments and explore our wide range of services.

Conclusion

In these turbulent times, staying informed about the impact of political stressors on precious metals is crucial for smart investment decisions. At Pawn Central, we’re here to guide you through the complexities of the market, ensuring you get the best value for your gold and silver. Whether you’re looking to invest or sell, our team is ready to provide expert advice and support. Visit us today in Galesburg, Rock Island, or Clinton, and let us help you navigate the world of precious metals with confidence.

Final Thoughts

As political stress continues to influence the precious metals market, staying proactive and well-informed is essential. Pawn Central is committed to providing you with the expertise and tools needed to make sound financial decisions. Whether you’re a seasoned investor or new to the world of precious metals, our dedicated team is here to assist you every step of the way. Trust Pawn Central to help you secure and grow your investment in these uncertain times